Monthly Archives: January 2020

We’ve been having a spirited interaction about photography and photo art, I would love to hear your thoughts on this image.

This post has 16 comments. Click here to read them

This entry was posted on Wednesday, January 15th, 2020 at 10:51 pm

You can follow any responses to this entry through the RSS 2.0 feed.

I just recently finally got my hands on the new Fujifilm X-Pro 3 in the Duratect Silver color, which to me is more of a Champagne color, but I love it, very classy looking! There are hundreds of Youtube reviews and online reviews that go into every detail and spec. so I won’t do that again, instead I woud like to share about where I see the X-Pro 3 fitting into the Fujifm X Series and how I will use it!

My overall impression, is that it is the best made and most ergonomic of all the rangefinder type cameras so far from Fujifilm. It fits great in my hands and has wonderfully natural feel in use. The “so called” hidden rear LCD that folds down is actually, for me, a nice touch. It is no touble to use when you need it, but it does help you keep your eye to the viewfinder. I set up the front button on the viewfinder lever to turn on playback and I can now shoot, review and continue without taking my eye away from the viewfinder. For waist level street shooting, something I rarely do, you can use the LCD folded down very effectively.

If I don’t do street photography and am no longer a photojournalist/documentarian, how could I like a camera designed mostly for that crowd???? I actually think the X-Pro 3 is a wonderful choice for people, travel, and Americana photography, and would work fine for nature/landscape as well. The X-Pro 3 has the same sensor and processor as the X-T3 and therefore makes identical images! It has some added features that we all hope will come to other bodies via firmware. A very effective HDR setting that delivers very nice and not overdone HDR shots for added dynamic range without looking like, well an HDR shot! Apologies to Jim Begley who is one of the very best HDR guys out there and his stuff does not look like a lot of poorly done HDRs that have given HDR a bad name!!!! The X-Pro 3 also shoots focus bracketing, and allows you to select a focus range to shoot within and has in camera clarity settings, very cool and very effective.

One question I’ve gotten from several friends is that since you have to pull down the rear LCD to do settings is that an inconvenience? No, not really. The X-Pro 3 can be set up to do almost anyhting you want to do wothout ever going into the menus. The Q menu of course can be displayed in the viewfinder, which is the best yet in terms of refresh rate and resolution for Fujifilm! By setting some of the back, top and front buttons to custom settings you can call up any frequently needed menu items up quickly. I found in a few days I could do almost everything with my eye still on the viewfinder!!!

One very nice change is that the self timer can now be set in the menus to stay on until “you” turn it off!!! Thaks you Fujifim, I know it’s a small thing but it ended a long held frustration as I use the self timer a lot for tripod shooting. ,Speaking of tripod shooting, would someone please get us an L Bracket soon!!!!!! Truthfully I don’t think the X-Pro 3 will get a lot of tripod use, I see it as a great hand holding camera!

When doing travel photography, or people work I will use this Lowepro Flipside Sport 10L AW bag to carry it and a selection of single focal length lense that bmath up withit grea! The 16mm f 2.8, 23mm f 2, 35mm f 2, 50mm f 2, 60mm Macro f 2.4 and the 90mm f 2 lenses, all fast and a great fit to the X-Pro 3.

When using the 23mm f 2 or the 23mm f 1.4 on the X-Pro 3 I love the Optical viewfinder, especially when things are happening and I want ot see what is happening outside the frame, this is a great featue of this camera!!!

So my Score is a 9.5 out of 10, Why not a 10?

If Fujifilm had added IBIS, it owuld have been a solid 10, but even without it I am falling in love with this classy, fun to use body that delivers the spectacular image quality we have come to expect from Fujifilm’s X Series cameras!

I bought a Vi Vante Luxury Arctic Fox Sheetline Rope Camera Strap from Amazon and for this body I love it, just adds to the already classy look of the body, plus it’s a very nice strap too!

Blessings,

the pilgrim

This post has 7 comments. Click here to read them

This entry was posted on Wednesday, January 15th, 2020 at 5:21 pm

You can follow any responses to this entry through the RSS 2.0 feed.

This ratio indicates how well a company is performing by comparing the profit it’s generating to the capital it’s invested in assets. The balance sheet is a very important financial statement for many reasons.

It can be looked at on its own, and in conjunction with other statements like the income statement and cash flow statement to get a full picture of a company’s health. This account may or may not be lumped together with the above account, Current Debt.

Business

Bonds Payable – liabilities supported by a formal promise to pay a specified sum of money at a future date and pay periodic interests. A bond has a stated face value which is usually the final amount to be paid. For serial bonds , the portion which is to be paid within one year is considered as a current liability; the rest are non-current. The same rule applies to other long-term obligations paid in installments. Total current assets came in at $134 billion for the quarter . The $134 billion versus the $89 billion in current liabilities shows that Apple has ample short-term assets to pay off its current liabilities.

- Managing short-term debt and having adequate working capital is vital to a company’s long-term success.

- Current liabilities are usually paid with current assets; i.e. the money in the company’s checking account.

- If the total of the cash and cash equivalents line items is much larger than the notes payable amount, you shouldn’t have any reason to be concerned.

- A company’s working capital is the difference between its current assets and current liabilities.

- Examples of current liabilities include accounts payable, interest payable, income taxes payable, bills payable,short-term loans, bank account overdrafts and accrued expenses.

For example, you might buy a company car for business use, and when you finance the car, you end up with a loan—that is, a liability. After all, some assets can’t be sold at their value as stated on the balance sheet. For example, money owed to the business by customers may not be collected.

Accounts payable is the opposite of accounts receivable, which is the money owed to a company. The accounts payable line item arises when a company receives a product or service before it pays for it. Long-term liabilities are anything that has a repayment schedule of a time period of more than one year. Items that are considered long-term liabilities include company bonds, and long-term loans such as mortgages and other statement of retained earnings example bank-loans. Company shares and stocks are recorded as long-term liabilities as are retained earnings which are profits that have been reinvested into the business. Among others, the definition given above is considered much comprehensive and has a wider acceptance. It emphasizes the relationship between entity’s current assets and current liabilities and is much important to understand the working capital management.

Lots of issues relating to liabilities in accounting affect the way a business is run, efficiency, profitability and growth. cash basis Knowing how your business is doing and what can be improved requires, among other things, liabilities be focused on.

In other words, the creditor has the right to confiscate assets from a company if the company doesn’t pay it debts. Most state laws also allow creditors the ability to force debtors to sell assets in order to raise enough cash to pay off their debts. For a bank, accounting liabilities http://dsofky.com/bookkeeping-6/trial-balance/ include Savings account, current account, fixed deposit, recurring deposit, and any other kinds of deposit made by the customer. These accounts are like the money to be paid to the customer on the demand of the customer instantly or over a particular period of time.

Again, equity accounts increase through credits and decrease through debits. When your liabilities increase, your equity decreases. Here are some sub-accounts you can use within asset, expense, liability, equity, and retained earnings income accounts. Assets and expenses increase when you debit the accounts and decrease when you credit them. Liabilities, equity, and revenue increase when you credit the accounts and decrease when you debit them.

Stay Up To Date On The Latest Accounting Tips And Training

However, if one company’s debt is mostly short-term debt, they might run into cash flow issues if not enough revenue is generated to meet its obligations. Also, if cash is expected to be tight within the next year, the company might miss its dividend payment or at least not increase its dividend.

These accounts for an individual are referred to as the Assets. Short-term debt is typically the amount of debt payments owed within the next year. The amount of short-term debt as compared to long-term debt is important when analyzing a company’s financial health. For example, let’s say that two companies in the same industry might have the same amount of total debt. Typically, vendors provide terms of 15, 30, or 45 days for a customer to pay, meaning the buyer receives the supplies but can pay them at a later date.

Assets are shown at the top, followed by liabilities, equity, and expenses. + Liabilities here included both current and non-current liabilities that entity owe to its debtors at the end of balance sheet date. This transaction creates a legal binding between an entity and suppliers. Such liabilities called account payable and class as current liabilities. Liability is a legal obligation of an individual or a business entity towards creditors arising out of some transactions.

Liability doesn’t always lead to litigation, and litigation doesn’t always happen because of your liability. If you run into legal trouble, trust an experienced lawyer. If you need your business liabilities to be accurate on the accounting end, trust Ignite Spot. We’re an online, outsourced accounting firm who can help you to organize your liabilities and expenses. Contact us today or download some of our free advice modules. In the case of non-payment creditors has the authority to claim or confiscate the company’s assets. Even in the case of bankruptcy, creditors have the first claim on assets.

But too much liability can hurt a small business financially. Owners should track their debt-to-equity ratio and debt-to-asset ratios. Simply put, a business should have enough assets to pay off their debt. This article provides more details and helps you calculate these ratios. Balance https://www.iiglive.com/accounting-entries-for-dividends/ sheet accounts tend to follow a standard that lists the most liquid assets first. Revenue and expense accounts tend to follow the standard of first listing the items most closely related to the operations of the business. For example, sales would be listed before non-operating income.

Interest Payable

The following is a look at liabilities, including how accounting software today has transformed liabilities accounting today. Contra-accounts are accounts with negative balances that offset other balance sheet accounts. Examples are accumulated depreciation , and the allowance for bad debts . Deferred interest is also offset against receivables rather than being classified Liability Accounts Examples as a liability. Liability accounts represent the different types of economic obligations of an entity, such as accounts payable, bank loans, bonds payable, and accrued expenses. As the title infers, the Unearned Income liability is booked when cash is received for a sale, but not earned in the current period. An example of this type of revenue is newspaper subscriptions.

These invoices are recorded in accounts payable and act as a short-term loan from a vendor. By allowing a company time to pay off an invoice, the company can generate revenue from the sale of the supplies and manage its cash needs more effectively. Considering the name, it’s quite obvious that any liability that is not current falls under non-current liabilities expected to be paid in 12 months or more. Referring again to the AT&T example, there are more items than your garden variety company that may list one or two items.

Entities that own enough quality current assets and are able to pay all of their current liabilities on time and without any hassle are considered to have a sound liquidity position. Such entities are generally capable of handling financial downturns in a better way. The reverse is true for entities with weak liquidity position.

For example, an airline that receives payments of $1,000 for airline reservations for the following month will record two corresponding transactions. The airline receives an asset (e.g. cash), but also incurs a $1,000 liability for unearned revenue since the actual service (e.g. air transportation) has not been performed yet. Current liabilities are expected to be paid back within one year, and long-term liabilities are expected to be paid back in over one year.

Section: Accounting Tutorial: The Account Types

Revenue or income accounts represent the company’s earnings and common examples include sales, service revenue and interest income. A chart of accounts is a list of the categories used by an organization to classify and distinguish financial assets, liabilities, and transactions. Here’s a sample balance sheet that shows the liabilities on the right and assets on the left, with the business’s equity noted at the bottom. Return on Assets is a type of return on investment metric that measures the profitability of a business in relation to its total assets.

What are examples of non current liabilities?

Examples of Noncurrent Liabilities

Noncurrent liabilities include debentures, long-term loans, bonds payable, deferred tax liabilities, long-term lease obligations, and pension benefit obligations. The portion of a bond liability that will not be paid within the upcoming year is classified as a noncurrent liability.

It’s important for companies to keep track of all liabilities, even the short-term ones, so they can accurately determine how to pay them back. On a balance sheet, these two categories are listed separately but added together under “total liabilities” at the bottom. Short-term loans are factored under a company’s current liabilities. Securing the loans are the company’s existing assets and inventory.

List Of Of Liabilities In Accounting

Dividends are cash payments from companies to their shareholders as a reward for investing in their stock. Liability Accounts Examples The treatment of current liabilities for each company can vary based on the sector or industry.

What are 3 types of assets?

Different Types of Assets and Liabilities?Assets. Mostly assets are classified based on 3 broad categories, namely –

Current assets or short-term assets.

Fixed assets or long-term assets.

Tangible assets.

Intangible assets.

Operating assets.

Non-operating assets.

Liability.

More items

In some cases, part or all of the expense accounts simply are listed in alphabetical order. Record lease liabilities on the balance sheet if they entail an agreement to purchase https://quick-bookkeeping.net/ the equipment and incur a payable debt similar to a loan payment. Determine what type of accounting transaction occurred and what account classifications it might have affected.

Initially keeping the number of accounts to a minimum has the advantage of making the accounting system simple. Starting with a small number of accounts, as certain accounts acquired significant balances they would be split into smaller, more specific accounts. However, following this strategy makes it more difficult to generate consistent historical comparisons. In this respect, there is an advantage in organizing the chart of accounts with a higher initial level of detail. The chart of accounts will appear in the listing, as shown in the figure below.

Because these loans have a short repayment schedule, the balance of the entire loan is recorded. Although an extensively applied tool for liquidity analysis, current ratio has only a limited usefulness.

It can help a business owner gauge whether shareholders’ equity is sufficient to cover all debt if business declines. Granted, some liability is good for a business as its leverage, defined as the use of borrowing to acquire new assets, increases, and a business must have assets to get and keep customers.

This post has Comments Off on What Are Current Liabilities? Definition, Explanation, Examples, Journal Entries, Presentation comments. Click here to read them

This entry was posted on Wednesday, January 15th, 2020 at 11:23 am

You can follow any responses to this entry through the RSS 2.0 feed.

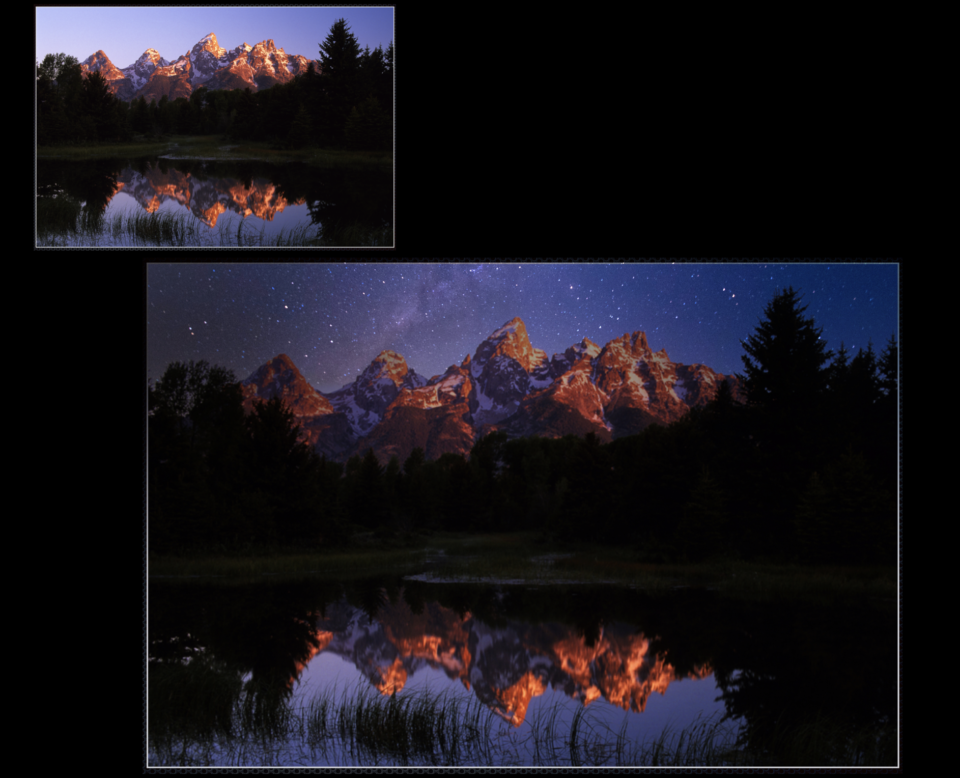

Above are four illustrations of what you can do with Luminar 4 and their sky replacement Artificial Intelligence! The question is, should you? Let’s talk about that, but first a little history. Many years ago in a galaxy far, far away, sorry about that, just couldn’t help myself. Long ago, in the early years of my career everyone in the nature field shot Kodachome 25. The goal was to shoot images that were as close to reality as possible! Then, Fujifilm introduced a new transparency film called Velvia. It produced slides that had deep rich colors that were far from accurate. While the goal of the moment was to reproduce natural colors, everyone fell in love with it and it became the “new” look. We gladly dumped Kodachrome because, well, we liked the new look, it wasn’t accurate, but the editors loved it, the rest is history.

As photographers we have to decide what we are going to make as our standard or goal with our work. If we are a photo journalists, or scienctific photographers then accuracy and realism is the standard we have to adhere to. If you are an artist trying to make a statement with your work, all bets are off, but it’s rarely that simple.

When I, and many of my friends, got into photography, the goal was to shoot accurate images, as time passed and Velvia came along, then digital, photoshop and well, you know the rest. Old horses like myself and some others I know, were thrown into a new world, one that was not what we came up with. The adjustment has been difficult. Difficult, but not impossible.

I don’t believe that doing post processing, even replacing skies is a sin, wrong or improper! Depending on how you learned this craft, it may or may not be and easy choice. As a photography instructor, it is important that I can be clear on how to deal with theses new possibilities when doing image reviews. Let me address that now. My first personal rule for all my own work and the work I review is that the photographer should simply tell what they have done if major changes to the image have taken place. For instance if the post work is levels, maybe curves, saturation and sharpening then I don’t think that needs to be mentioned. If the changes include Sky replacements, as the illustraitons above, then I think it would be approriate to mention that.

I think all photographers have the right and opportunity to do as they wish with their images. You will get no judgement from me. If an image works, it works. If you can live with your post then so can I. We do this for fun, let’s keep it that way!

Blessings,

the pigrim

This post has 33 comments. Click here to read them

This entry was posted on Friday, January 10th, 2020 at 7:50 pm

You can follow any responses to this entry through the RSS 2.0 feed.